Site for Post-resignation Procedures for Corporate-type Defined Contribution Pension Plan

This service is available only to customers who have been enrolled in our corporate-type DC plan and have been registered to use our English service by their company.

If you have reached the age of 60 and want to receive your pension assets as retirement benefits, this is not the correct website.

Procedures at the time of resignation

If you resign before the age of 60, it is necessary to complete these procedures within 6 months after resignation (date of loss of participant eligibility). Please note that if the necessary procedures are not completed within 6 months, your pension assets will be automatically rolled over to National Pension Fund Association and additional fees will be incurred.

In most cases, one of the following three procedures is required.

Among the procedures listed in the leaflet "Procedures upon Loss of Participant Eligibility due to Resignation or Related Reasons(PDF)", this website provides a brief guide to three procedures that are most likely to apply to foreign customers.

New company in Japan offers a corporate-type DC plan

1. Procedures for asset rollover to corporate-type DC plan offered by new company

New company in Japan does NOT offer a corporate-type DC plan(Including self-employed)

2. Procedures for asset rollover to individual-type defined contribution pension plan (iDeCo)

No longer living in Japan

2. Procedures for asset rollover to individual-type defined contribution pension plan (iDeCo)

or

1.Procedures for asset rollover to corporate-type DC plan offered by new company

First, please check with the pension department at your new company whether the plan administrator of the corporate-type DC plan offered by your new company is Sompo Japan DC Securities or not.

In the case that the plan administrator is Sompo Japan DC Securities

The account opening procedure for a new corporate-type DC plan will be completed by the pension department at your new company.

Please wait for your "Notice of Opening an Account for the Defined Contribution Pension Plan" to be mailed to you.

For rollover procedures, you can either print out a "Request to Rollover DC Asset Balance to New Corporate-type DC Plan" on the AnswerNet (web service for participants) or Site for Defined Contribution Pension Plan Starter Kit and submit it to us, or submit the form to the pension department at your new company.

Once your account is opened, you can provide investment instructions for rollover assets. Please provide your instructions by the day before the date of receiving such assets.

Site for Defined Contribution Pension Plan Starter Kit

In the case that the plan administrator is not Sompo Japan DC Securities

Please inform the pension department at your new company that you were enrolled in a corporate-type DC plan at your previous company and want to transfer your assets. You do not need to contact Sompo Japan DC Securities.

POINT!!

- It takes approximately 2 to 3 months to complete rollover procedures after submitting the necessary documents.

- If your basic pension number, date of birth, and gender are not registered correctly at your previous company and/or your new company, they need to be corrected before starting rollover procedures.

- If you do not want to transfer your assets to the corporate-type DC plan at your new company, you can open an account for iDeCo by yourself and transfer your assets to this account.

2.Procedures for asset rollover to individual-type defined contribution pension plan (iDeCo)

If you do not participate in the corporate-type DC plan at your new company, you need to open an account for iDeCo and transfer your assets to this account.*

- Anyone can apply for asset transfer to iDeCo (Rollover).

- There are certain requirements for making monthly contributions to iDeCo (Participation).

- iDeCo is administered by the National Pension Fund Association(国民年金基金連合会).

- Most documents for iDeCo are in Japanese. Even if you were registered to use our English service for the corporate-type DC plan of your previous company, you need to take most of the procedures in Japanese. (Only for eligible persons, English support is available through the AnswerNet, telephone and inquiry form.)

*In some cases, such as when your asset amount is 15,000 yen or less, or when you are exempt from paying national pension premiums, early lump-sum payment may be claimed.

- For iDeCo features and fees, please click here.(PDF)

- For the Investment Product Lineup for iDeCo, please click here.(PDF)

- For more detailed information, please refer to our official website.(Japanese only)

- Note:Other financial institutions are also offering an individual-type DC plan. For details, please refer to the list of plan administrators posted on the official website of the NPFA.(https://www.ideco-koushiki.jp/operations/)

POINT!!

There are certain requirements for making contributions (participation) in iDeCo.

The following persons are not eligible to join.

- Those who are not enrolled in the National Pension, the Employees' Pension Insurance nor a dependent on their spouse.

- Those who are exempt from paying national pension premiums. (including partial exemption and non-payment)

- Those who are enrolled in the Farmers' Pension.

- Those who are receiving early payment of Old-age Basic Pension.

- Those who are receiving or have received retirement benefits under iDeCo. (including lump-sum payment)

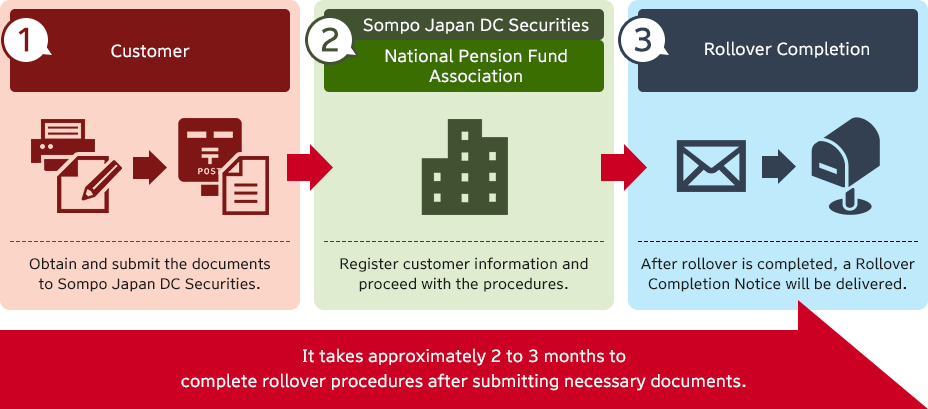

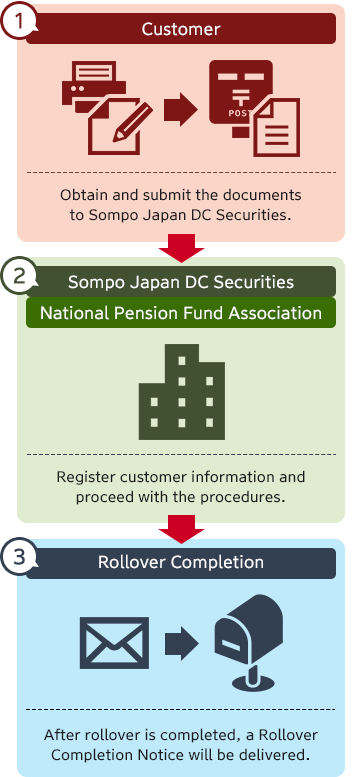

Flow of iDeCo account opening and rollover procedures

In principle, the procedures must be completed in writing.

In order to obtain procedural documents, please select either "by postal mail" or "by download (print by yourself)" from the "Document Request" button below.

POINT!!

- Please obtain and submit the documents to Sompo Japan DC Securities.

- Please make sure to mail the original completed documents.

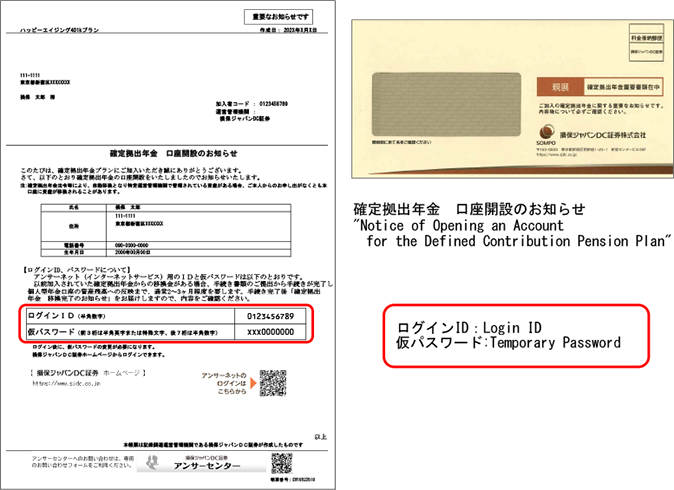

- Once your information is registered and your iDeCo account is opened, you will receive a "Notice of Opening an Account for the Defined Contribution Pension Plan" from us. Please log in to the AnswerNet with the ID and temporary password provided. Please check "Asset Rollover/Asset Conversion Instructions". If you make contributions, please provide "Contribution Instructions".

- Assets have not been rolled over yet when an account is opened. You need to designate investment products to purchase with rollover assets before receiving such assets.

- The scheduled asset rollover date will not be notified.

- It takes approximately 2 to 3 months to complete rollover procedures after submitting necessary documents.

Image of "Notice of Opening an Account for the Defined Contribution Pension Plan"「確定拠出年金 口座開設のお知らせ」

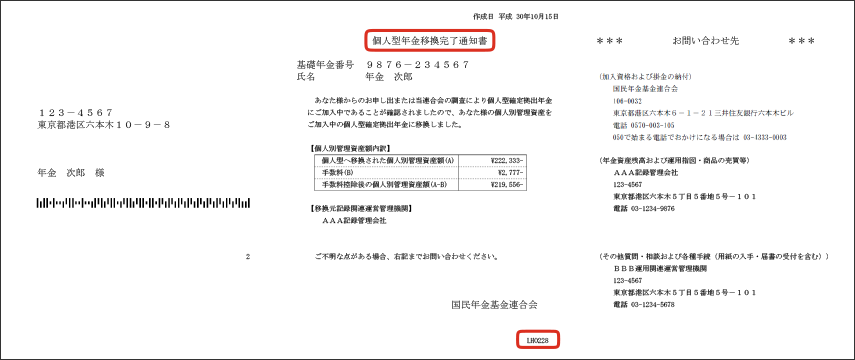

OK After the transfer is completed, you will receive a "Notice of Complete Rollover Procedures to Individual-type Defined Contribution Pension Plan"「個人型年金移換完了通知書」from National Pension Fund Association.(国民年金基金連合会)

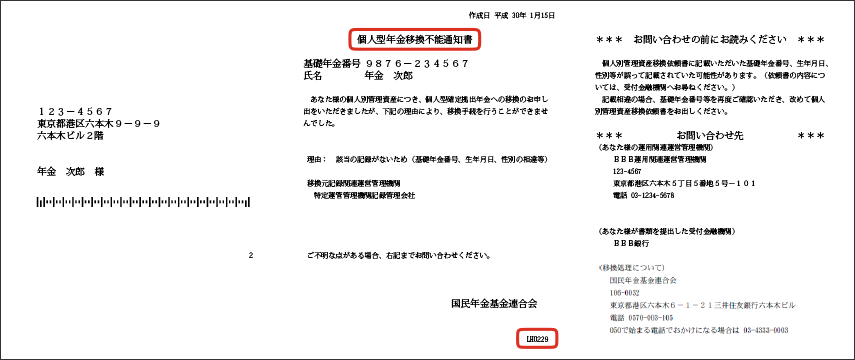

NG If you receive a "Notice of Incomplete Rollover Procedures to Individual-type Defined Contribution Pension Plan"「個人型年金移換不能通知書」from National Pension Fund Association, please contact us as the rollover procedure could not be completed.

OK

Image of "Notice of Complete Rollover Procedures to Individual-type Defined Contribution Pension Plan"

「個人型年金移換完了通知書」

*"LH0228" is written at the bottom of the notice letter.

NG

Image of "Notice of Incomplete Rollover Procedures to Individual-type Defined Contribution Pension Plan"

「個人型年金移換不能通知書」

*"LH0229" is written at the bottom of the notice letter.

How to apply

Please mail the necessary documents to us.

Please click the "Document Request" button below to obtain the forms.

Online procedures are also available with Japanese support only.

- Notice: We do not provide English support for online procedures. Overseas addresses cannot be registered online.

3.Claim early lump-sum payment

In principle, early withdrawal from (cancellation of) the DC plan is not allowed. Assets are receivable after the age of 60 to 65, depending on the total participation period. Requirements for early withdrawal (cancellation) are stipulated in the Defined Contribution Pension Act. An early lump-sum payment can be claimed if all the requirements are met. If early withdrawal is not possible, you need to transfer your assets to iDeCo.

~Example of when an early lump-sum payment can be claimed (all the requirements below must be met)~

- Overseas residents who do not have Japanese nationality.

- Under 60 years old.

- Total contribution period is not more than 5 years; or individual asset amount is not more than 250,000 yen.

- Within 2 years from the date of loss of participant eligibility in a DC plan.