About Sompo Japan DC Securities

Message from Management

“A Prosperous Future in DC Together”

Sompo Japan DC Securities Inc. (SJDC) celebrates its 25th anniversary in May 2024.

As a pioneer of defined contribution pension (DC) in Japan, SJDC is committed to supporting our customers in the “Age of the 100-year Life”.

My name is Osamu Nosé. I am the President and CEO of Sompo Japan DC Securities Inc. (SJDC).

We are one of the few companies in Japan that specializes in defined contribution pension (DC), offering comprehensive end-to-end service. As a member of the SOMPO Group, SJDC strives for a future of health, wellbeing and financial protection for all members of society.

As public pensions face financial difficulties from the declining birthrate and aging population, DC continues to gain social significance as a solution to this issue. In recent years, the number of participants in individual-type DC (iDeCo) has been increasing rapidly. A growing number of companies are implementing corporate-type DC to support the financial stability and well-being of their employees. In addition to the various preferential tax treatments that come with DC – especially with corporate-type DC – companies are able to expand human capital management by improving benefit programs, recruiting and retaining human resources, and more.

For corporate-type DC, we offer a unique end-to-end service that includes plan implementation, provision of investment product information, account management, investment education, a call center and web services for employees. This specialized approach has been highly valued by many of our customers. We also provide comprehensive services related to iDeCo.

In particular, our full range of English services has made SJDC the industry leader* in the number of contracts with foreign-affiliated companies with DC plans.

*This estimate is based on data released by the Ministry of Health, Labour and Welfare.

In order to make DC more accessible to customers, we are also focusing on high-quality services to meet the needs of customers who "don't know anything about asset management," by providing the first web service that utilizes a robo-advisor in Japan.

As our purpose “A Prosperous Future in DC Together” says, we are committed to improving our services to meet a wide range of customer needs throughout all stages of their lives. We will not rest on our laurels as pioneers of DC in Japan. We will continue to stay focused on providing value to our customers and making the utmost efforts to create a society in which customers do not have to worry about their financial well-being in old age.

Corporate Profile

| Name | Sompo Japan DC Securities Inc. |

|---|---|

| Date Established | May 10, 1999 |

| Capital | 3 billion yen (current as of end of August, 2009) |

| Address | ■Head Office Shinjuku Center Bldg. 50F, 25-1 Nishi-Shinjuku, 1chome, Shinjuku-ku, Tokyo 163-0650, Japan(MAP) ■Osaka Office Sompo Japan Higobashi Bldg.6F, 11-4 Edobori, 1chome, Nishi-ku, Osaka 550-8577, Japan |

| Representative | Osamu Nose, President and CEO |

| Principal Shareholders (Shareholding %) | Sompo Japan Insurance Inc. (100%) |

| Main Business | Defined contribution pension plan services Financial instruments business |

| Registration Certificate of Defined Contribution Pension Plan Administrator | Defined Contribution Pension Administration Services Registration Number 15 Sompo Japan DC Securities Inc. (Registered on November 27, 2001) |

| Financial Instruments Firm Registration Number / Place of Registration | No.106, as appointed by the Director of the Local Finance Bureau of Kanto. |

| Industry Organization Membership | Japan Securities Dealers Association |

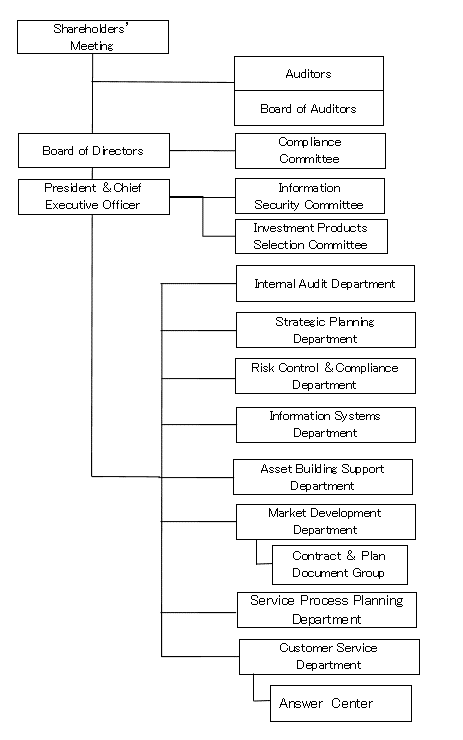

| Organization Chart |  |

| Company Introduction Video |

Positioning of the DC Business within Sompo Japan

Sompo Japan Strategy For the 21st Century

Sompo Japan has established its client base and reputation of credibility over more than a hundred years through dedicated customer service. In addition to its core non-life and life insurance businesses, asset management is the third pillar of growth for the company’s future. The defined contribution pension business plays a strategic role within this framework and will be aggressively expanded going forward.

DC Plan Services in English (optional only for corporate-type DC plans)

We provide the following English services:

- Textbooks and other materials

- Participant Website

- Call center for Participants

- Investment Seminars